BoJ Takes Pause in opening New Season of “Cheap Money”, Complicating Decision for the Fed

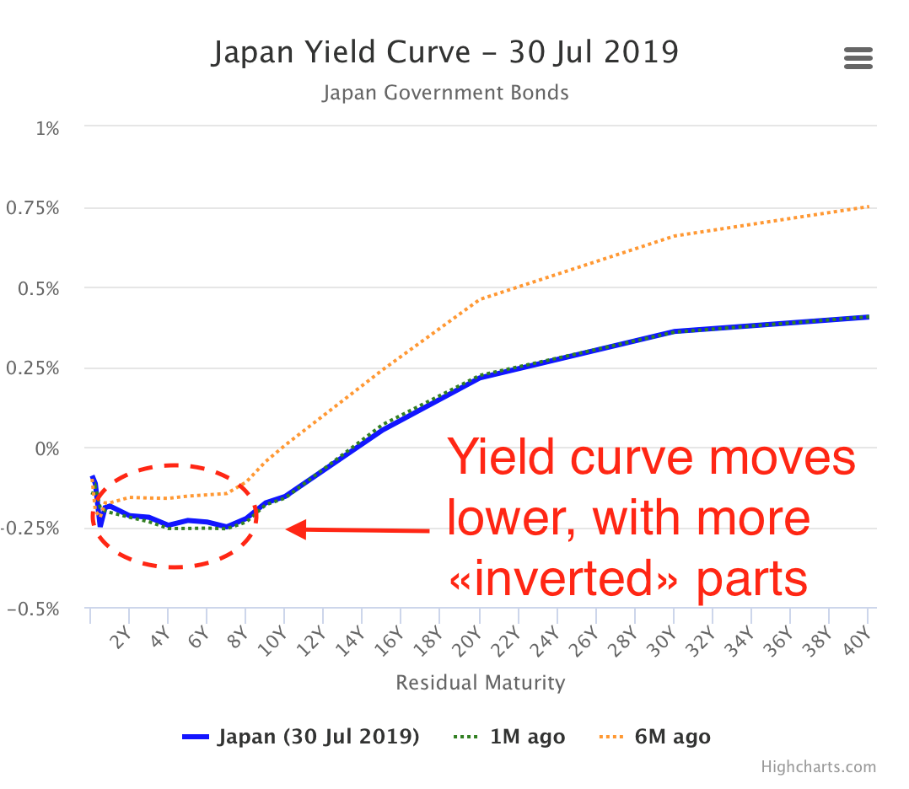

Bank of Japan left the amount of monetary stimulus unchanged at the meeting on Tuesday, however, it signaled its readiness to cut rates and ramp up bond purchases significantly if the risks associated with global growth materialize in the domestic economy.

The bank’s decision carries little, if any surprise for the Yen as BoJ has been least successful in forecasting and pushing inflation to the target among its peers and the baseline case for its actions is unlimited assistance to the economy.

But with ECB hitting pause button once more before opening the “new season” of cheap money increases the likelihood that the Fed will take only a modest step towards easing, by only 25 basis points. However, the chance for aggressive rate cut by 50 bp continued to increase, reaching 27.1% on Tuesday. There is a growing conviction among investors that retail sales, GDP, employment and other “lagging” indicators should now worry the Fed less than a drop in corporate optimism and a squeeze of investment. Aggressive rate cut should be the necessary shock that can outweigh caution and distrust, fueled by trading tensions.

Years of low interest rates have eroded the margins of the banking sector in Japan, which brings the Japanese Central Bank to the limit of using non-traditional instruments, apart from inflation being immune to rapid expansion of money supply. For the Central Bank, it is also important to “preserve the ammunition” in the absence of Yen appreciation, which also paves the way for less dovish wordings. If the Fed’s decision causes a strengthening of the yen, the Bank of Japan may expand the horizon of policy guarantees (aka forward guidance) or allow the yields of 10-year bonds to move in a wider range, as was done earlier.

BoJ’s policy stance in July hardly differs from June, but a new line appeared in the statement, which says that the Central Bank is ready to increase stimulus without any hesitation, if the chances that the inflationary momentum is lost, will grow. This is actually rephrasing of the notorious “whatever it takes” wording of Draghi we heard in 2013. But Yen has so far developed resilience to the dovish stunts of the BoJ.

The Japanese yen strengthened against the dollar by a quarter percent due to increased demand for safe assets, as well as return of Japanese investors “home” before the extremely uncertain outcome of tomorrow's Fed meeting. Together with the yen, gold and the Swiss franc rose by 0.61% and 0.16%, respectively.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.