Daily Market Outlook, October 15, 2019

Main Market Themes

Geopolitical uncertainties returned to the fore overnight, as the Trump administration announced sanctions on three senior Turkish officials and will raise steel tariffs back up to 50% as well as stop trade negotiations, while calling on Turkey to implement an immediate ceasefire on Syria. On the US-China trade front, market doubts started to emerge after US Treasury Secretary Mnuchin warned additional tariffs would be imposed if a deal with China falls apart, while China said it wants further talks this month to hammer out the details before inking the deal.

A Telegraph report on the Brexit deal taking shape lifted the GBP briefly.Liquidity remains poor and volatility high in GBP, with a fast and positive move this morning after EU Chief negotiator Barnier suggested a deal can still be reached by the end of this week. As such, while data should start to become more important in the weeks ahead, Brexit headlines will dominate price action for now.

Bank of Japan Governor Kuroda who was speaking at a BOJ Branch managers’ meeting this morning, repeated the pledge of further easing if risks grow that momentum towards achieving the 2% price target is lost. But markets saw nothing new from Kuroda and that left yen virtually changed.

Market players are also waiting for further cues from the US’ 3Q earnings season starting with JPMorgan Chase, Goldman Sachs, Citigroup and Wells Fargo today.

Today’s economic data calendar comprises of the UK’s jobless claims and ILO unemployment rate, EZ/German ZEW survey and Indian trade data. Speakers include Fed’s Bullard, George and Daly, and BOE’s Carney and Vlieghe

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.0950-55(660mln), 1.1015-20(1.07bln), 1.1100(532mln), 1.1200(646mln)

- USDJPY: 106.50(579mln), 107.00-10(2.1bln), 107.40-50(589mln), 107.75-85(636mln), 108.00-20(1.62bln), 109.00-10(962mln), 110.00(824mln)

- GBPUSD: 1.2200(713mln), 1.2600(1.0bln)

- AUDUSD: 0.6800(624mln), 0.6880-00(812mln)

Technical & Trade Views

EURUSD (Intraday bias: Bullish above 1.10 targeting 1.11)

EURUSD From a technical and trading perspective 1.1045 target achieved. As 1.10 prior resistance now acts as support look for consolidation to form a platform for bulls to make a run at 1.11 over the coming sessions. Only a failure below 1.0960 would concern the bullish bias.

GBPUSD (Intraday bias: Bullish above 1.25 targeting 1.28)

GBPUSD From a technical and trading perspective as 1.25 now acts as support look for bullish reversal patterns on on intraday basis to set long positions targeting an equidistant swing objective at 1.28, on the day only below1.2450 would concern the bullish bias.

USDJPY (intraday bias: Bullish above 107.80 targeting 109)

USDJPY From a technical and trading perspective as 107.85 now acts as support look for a move through last weeks highs enroute to test offers and stops above 109 on the day only a move through 107.40 would concern the bullish bias.

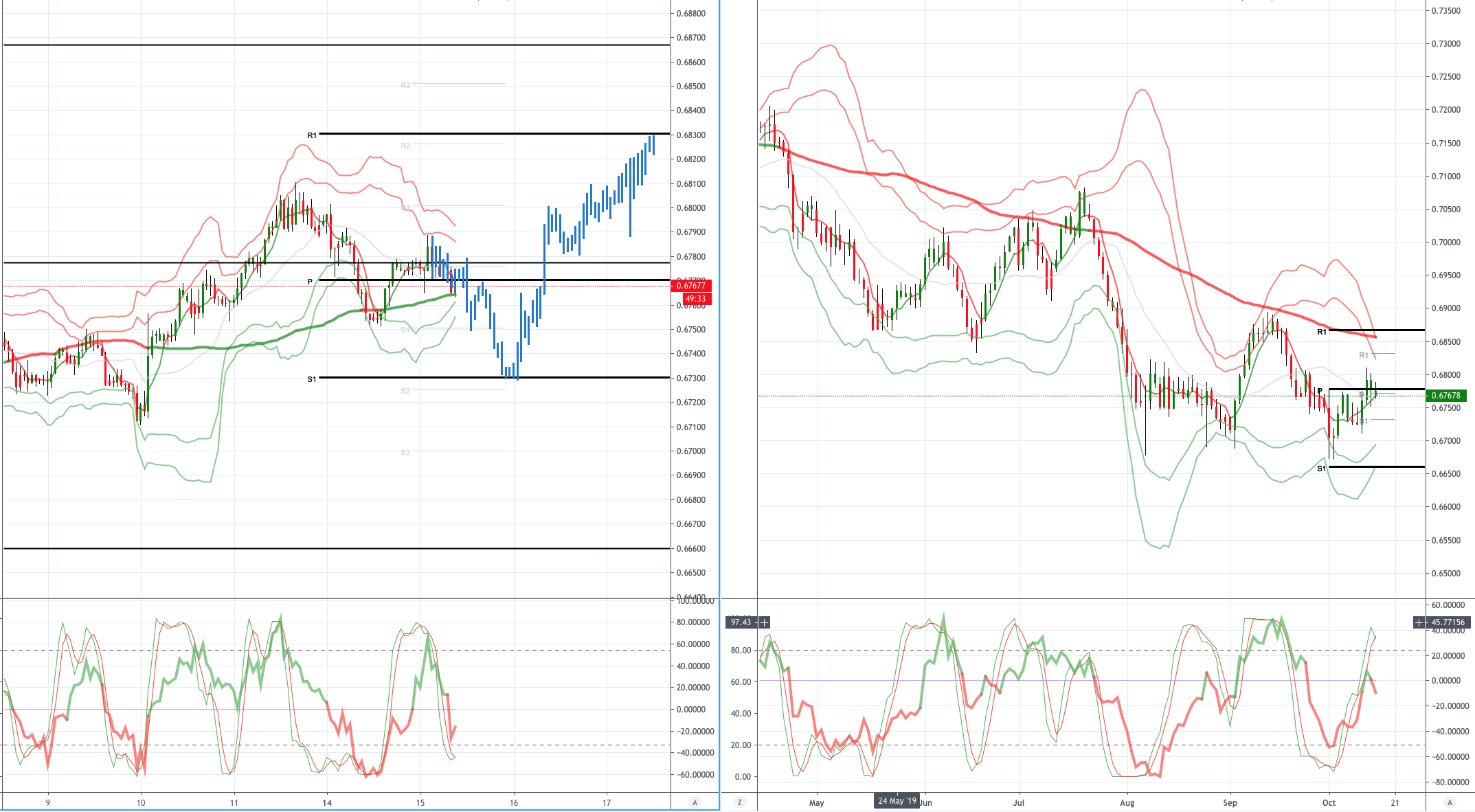

AUDUSD (Intraday bias:Neutral bullish above .6780 bearish below .6730)

AUDUSD From a technical and trading perspective .6800 upside objective achieved,a failure below .6750 would concern the bullish bias and suggest a false break and a return to the range of .6700-.6800, a move back through .6810 is needed to keep upside momentum and set sights on offers and stops above .6865

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!