July US Inflation Failed to Surprise Markets as Temporary Drivers Fade

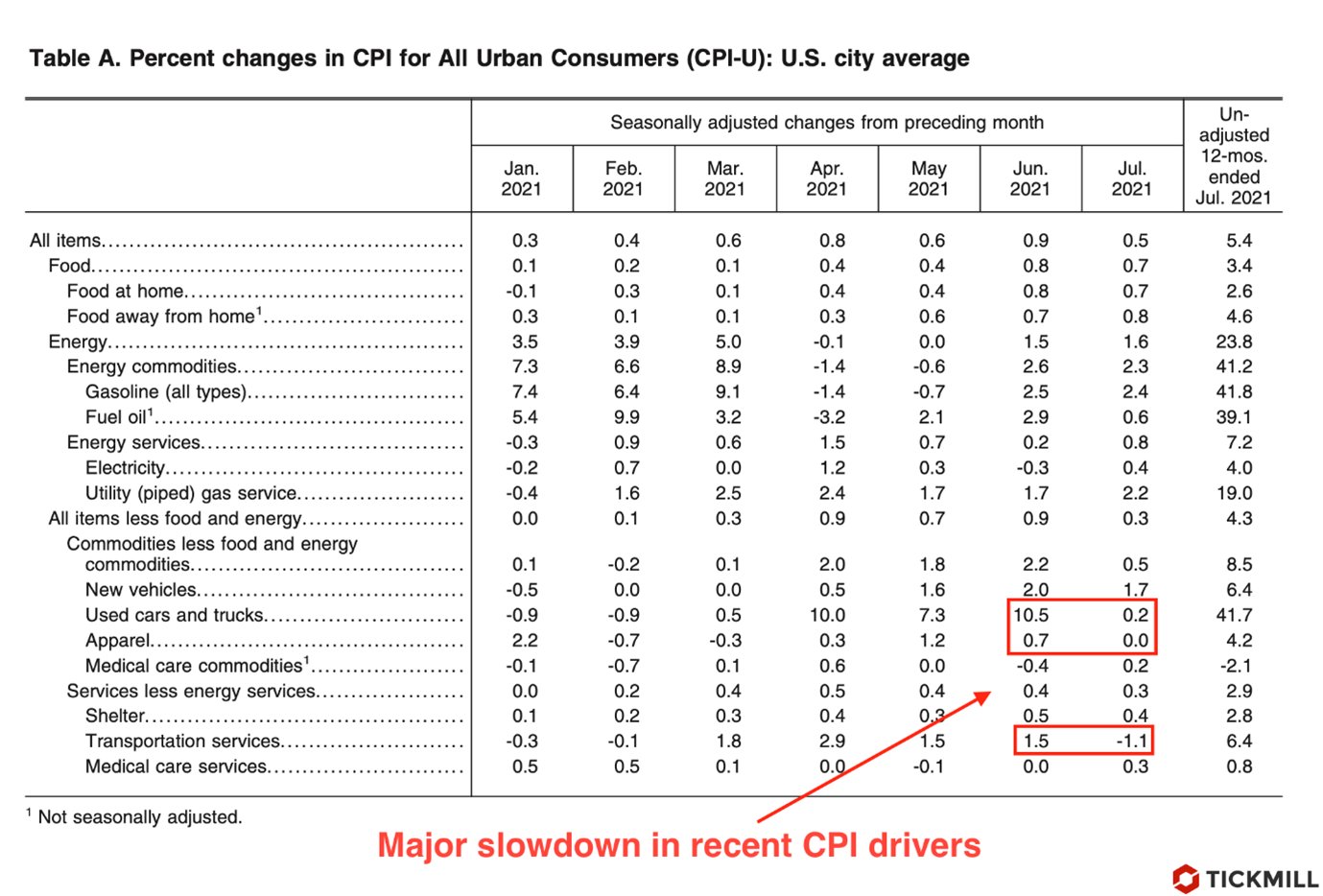

Inflation in the US rose by 0.5% in July in monthly terms, which was in line with expectations. However, core inflation rose by 0.3%, which was less than the forecast of 0.4%. Annual inflation remained unchanged compared to June and amounted to 5.4%.

The data for the first time in several months indicated a sharp slowdown in the growth of used car prices. This CPI component showed an average growth of 10% MoM for three months in a row, making a significant contribution to the rise in overall inflation. In June, used cars rose in price by only 0.2%. In addition, prices for air tickets interrupted growth, sliding by 0.1% MoM. These two components were the main reason why core inflation fell short of forecasts:

It can also be noted that the coverage of inflation has become broader - the number of categories of goods where the monthly price increase was zero or positive has increased. For example, prices in recreation category rose by 0.6% MoM, in housing services by 0.4% MoM. Price growth of medical services amounted to 0.3% MoM

Judging by the behavior of the key CPI drivers (cars, air tickets, fuel), the annual inflation has most likely passed its peak and is now going to decline. Nevertheless, return to the comfortable for the Fed inflation range with an average of 2% may be delayed. The main reason is the stimulus-driven boom in the US economy. Demand continues to recover faster than supply and with the scars the pandemic has left on the economy, adjustment will take longer than the policymakers expect. This also applies to the labor market, where the demand for labor also exceeds supply, which is why inflationary pressure on wages persists. The latest US NFIB report indicated that a record high proportion of small businesses have unfilled vacancies. JOLTS data for June showed that the number of posted vacancies was 3.4 million more than the number of people hired. On the side of production ISM data still point to record low levels of inventories, and delays in the supply of goods and raw materials are also near extreme levels.

All this leads to the fact that price pressures in the economy continue to be high. Thanks to strong stimulus-fueled demand, companies feel that their price power is increasing. According to the same NFIB report, the number of companies that have raised or are about to raise final prices are at their peak for 40 years. Therefore, the prospects for inflation persistence in the United States remain very high, even though its peak may have already passed.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.