Crude Fighting Back

Following heavy selling across the start of the week, oil prices have since stabilised and are now starting to recover. Crude futures found support into the 72.61 level with the market since gaining around 2.5% of the week’s lows. The latest EIA data on Wednesday helped to assuage demand concerns with the group reporting an almost 5-million-barrel drawdown last week, more than double the 2-million-barrel draw forecast and a stark shift from the prior week’s 1.4-million-barrel surplus.

US Economic Fears

The data comes amidst shifting views on the US economy as traders continue to grapple with recessionary fears. A lower trending jobs market has raised concerns over the risk of a downturn in coming quarters, with inflation now falling steadily again also. However, better-than-forecast retail sales helped to smooth these concerns. This week, PMI readings for July offered a mixed view with the services sector seen growing firmly while manufacturing fell deeper into negative territory.

Fed Easing Forecasts

For now, it seems the prospect of a weaker US Dollar in line with increasingly dovish Fed expectations is helping underpin oil prices somewhat. Today, traders will be watching for fresh dovish signals from Fed’s Powell to help drive oil prices higher as USD comes under fresh pressure. Oil might receive an additional boost if Powell makes any comments that downplay recessionary risks while keeping the focus on expected easing in September.

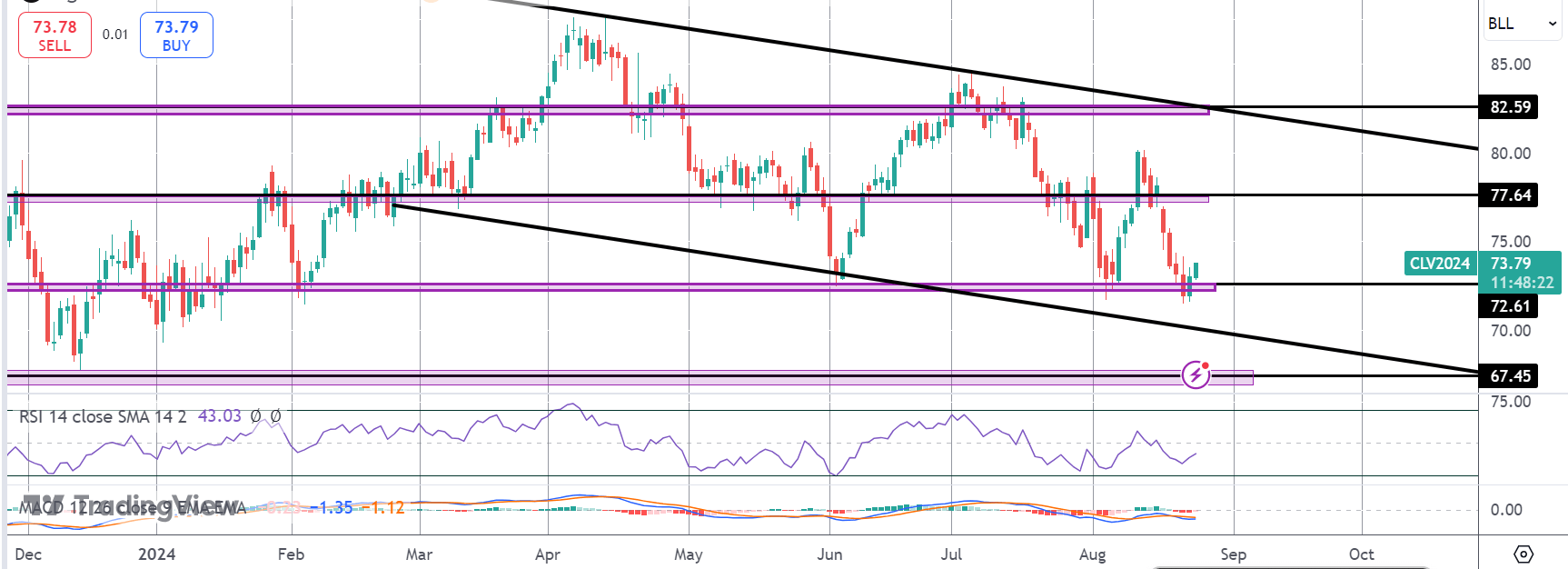

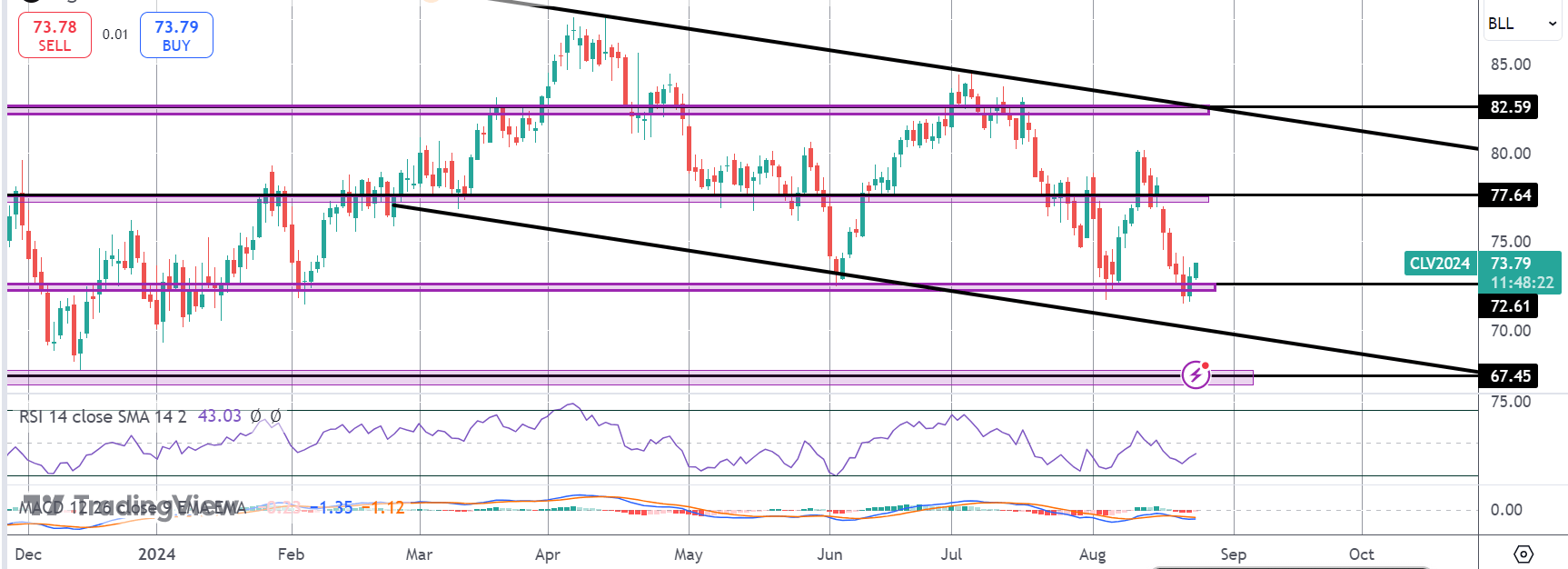

Technical Views

Crude

The sell off in crude has stalled for now into the 72.61 level with price now seeing a shallow bounce. While this level holds, a fresh rotation back up towards 77.64 is viable. Below here, however, focus shifts to 67.45 as deeper support, with the bear channel lows coming in ahead.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.